Highlights

- Will be a huge step for Whatsapp after video calling and My Status features

- Payments will be made via UPI gateway, discussion with banks ongoing

- India is going to be the first market to receive WhatsApp payment service

Almost every WhatsApp user had appreciated the introduction of the Video Call feature by WhatsApp lately. However, now it has something bigger to offer. When there are plenty of application that allows users to make payments, WhatsApp has also showcased its the intentions of entering into UPI domain service soon. With the milestone of 1 Billion active users everyday, WhatsApp is likely to garner a great amount of business with its new feature. Aren’t you looking forward to the WhatsApp Payment system already?

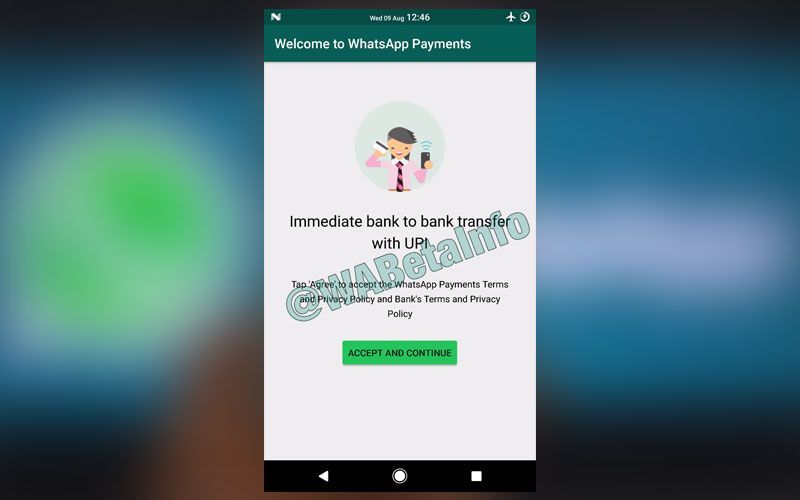

One of the most widely used social networking application worldwide, WhatsApp is now getting into payments now. Reports of which, aired a few months back, but now a beta version of the app has surfaced, which reflects a UPI payment option using peer-to-peer (P2P) money transfer. The WhatsApp’s payment feature is being built on government’s Unified Payments Interface (UPI) and India is likely to be the first market to get the service. The technology blog WABetaInfo spotted the WhatsApp version ‘2.17.295’ on the Google Play Beta Program.

According to the screenshot released by the WABetaInfo, the official WhatsApp Payment section for the Android read, “The immediate bank-to-bank transfer with UPI”. It asks users to accept the WhatsApp Payments and Bank Term and Privacy Policy. There were reports earlier that WhatsApp is having talks with India’s larger banks to launch a payment system.

See Also:

The Next Nokia Smartphone Will Have A Massive Screen Size

14 days agoAs mentioned earlier, there are a plenty of apps that allow UPI payments, but the biggest rival of WhatsApp in India is assumed to be Hike Messenger, which rolled out Hike Wallet recently, allowing users to make in-app payments. Reportedly Skype has also made a tie-up with PayPal to allow in-app (P2P) money transfer.

After the demonetisation move, India has emerged as one of the biggest emerging markets for online payment services. Also, there are a very large number of active WhatsApp users in India, which may also work to attract an interest for using its payment service. Obviously, who would like to download a separate app for making payments when their own messaging app is allowing them to transfer money to their friends and family, in a single app? The changes of payments through Whatsapp are surely bright!